Insights

Industry

Services

Advisor

QuickBooks users: It’s Time For A Mid-Year Review

Working with cluttered QuickBooks records can be frustrating. Take the time now to inactivate old accounts, merge duplicates, and delete what you no longer need. It can save you hours (and headaches) at year end.

Whittlesey Plain English Answers to CMMC Questions

We’ve outlined the most frequently asked questions about CMMC compliance and how your organization can begin preparing now.

Q2 2025 Real Estate Tax & Market Insights

Stay ahead in Q2 2025 with expert tax and market insights tailored for commercial and affordable housing real estate. Explore tax law updates, planning opportunities, and compliance trends to optimize your strategy and mitigate risk.

Navigating Connecticut’s Commercial Real Estate Tax Incentives

This guide outlines the most current and impactful tax incentives available to developers, investors, and property owners as of mid-2025.

First Quarter, 2025 | Peer Data for New England Banks

Whittlesey has released our financial data compilation for New England banks for the first quarter of 2025.

Put Your Nonprofit’s Cybersecurity to the Test with Penetration Testing

How well does your nonprofit’s cybersecurity program protect you from hacking? Penetration (pen) testing helps find vulnerabilities so you can, if necessary, strengthen your defenses.

How to Make Cost-Allocation Decisions for Your Nonprofit

Does your nonprofit struggle with the task of allocating costs to programs and supporting activities? This brief overview of some applicable accounting standards can help you get it right.

7 Ways To Cut Nonprofit Costs Rather Than Staffers

Due to federal funding reductions, some nonprofits may be tempted to conduct layoffs. Before you take this step, look for other ways to cut costs. We share seven tips.

Tips for Nonprofits Planning a Software Change

If your nonprofit is considering a software change, here are key areas to plan around and insights many organizations miss.

Insuring Construction Projects Under a CCIP

Construction business owners: Are high insurance costs and administrative hassles on your projects getting out of hand? One potential solution is a contractor-controlled insurance program.

Construction Business Owners: Avoid These Two Common Accounting Problems

Construction business owners: Are your accounting processes as good as they could be? Here are two common problems that tend to cause contractors to struggle in this area.

How Construction Business Owners Can Simplify Succession Planning

Construction business owners: Is your company ready for the future? Learn how to create a strong succession plan to ensure a smooth leadership transition and long-term success.

The Hidden Value of HR Audits: Why Every Organization Should Conduct One

Uncover the hidden benefits of HR audits and why every organization should perform one. Understand how HR audits can minimize legal risks, enhance compliance, and streamline operational efficiency.

FinCEN Eliminates Beneficial Ownership Reporting Requirements for U.S. Companies and Persons

On March 21, the U.S. Treasury Department’s Financial Crimes Enforcement Network (“FinCEN”) published an interim final rule (the “March 21 Rule”) that significantly narrows the beneficial ownership information (“BOI”) reporting requirements of the Corporate Transparency Act (“CTA”) and extends the CTA’s BOI reporting deadline for 30 days.

Do You Need to File a Gift Tax Return in 2024?

Wondering if you need to file a gift tax return for 2024? Learn about IRS requirements, exclusions, and deadlines. Find out when filing is required and why it may be beneficial even when it’s not mandatory.

Maximizing Employee Transportation Fringe Benefits: Save on Commuting Costs and Taxes

Save on commuting with tax-free employee transportation fringe benefits in 2025. Learn how mass transit, parking, and van pooling perks can cut costs and taxes.

Planning for the Future: 5 Business Succession Options and Their Tax Implications

Explore five business succession options and their tax implications to ensure a smooth transition and protect your financial future. Learn strategies for family transfers, trusts, ESOPs, and selling to employees or outside buyers.

Common Mistakes Small Businesses Make at Tax Time (and How to Avoid Them)

Learn how small businesses can streamline tax season and stay compliant.

Fourth Quarter 2024 | Peer Data for New England Banks & Credit Unions

Whittlesey has released our financial data compilation for New England banks for the fourth quarter of 2024.

Protect Your Business with a Comprehensive Network Assessment

A Network Assessment isn’t just about identifying problems—it’s about building a smarter, safer foundation for your organization. Here are the critical elements of a strong assessment.

The Standard Business Mileage Rate Increased In 2025

The price of gas is slightly higher than it was a year ago. How does this affect the amount you can deduct for business driving in 2025? Here’s the latest on the cents-per-mile rate for this year.

Third Quarter 2024 | Peer Data for New England Banks and Credit Unions

Whittlesey has released our financial data compilation for New England banks and credit unions for the third quarter of 2024.

Understanding the Work Opportunity Tax Credit

With unemployment low, many small businesses need more employees. The Work Opportunity Tax Credit can help if you hire from certain targeted groups.

Rolling Forecasts Can Provide Clarity for Manufacturers

Has your manufacturing company considered the benefits of rolling forecasts?

2 Labor-Related Costs Manufacturers Need To Keep In Check: Workers’ Comp And Unemployment Insurance

Successfully managing your workers’ compensation and unemployment insurance costs can help boost your manufacturing company’s bottom line.

Evaluating Your Manufacturing Company’s Multistate Tax Liability

Not knowing if your manufacturing company is liable for multistate taxes can lead to unexpected financial hurdles. A nexus study can help.

Federal Court Rules Against DOL’s “White Collar” Overtime Rule

A federal court has struck down a new rule regarding the salary threshold for determining whether employees are exempt from federal overtime pay requirements.

What’s Next? Evaluating Potential Tax Impacts Post-2024 Election

Discover the potential tax impacts post-2024 election as President-Elect Donald Trump returns to the White House.

Are Your Nonprofit Board Meetings as Focused as They Could Be?

Good planning is critical to keeping nonprofit board meetings short and effective. This starts with a detailed agenda that includes timetables and assignments. Learn more.

When Your Nonprofit’s Debt-Financed Income Is Subject to Tax

Much nonprofit investment income isn’t taxable, but there are exceptions. These include income from certain debt-financed property (generally, real estate). Here’s what you need to know.

Welcome Charitable Pledges — And Account For Them Properly

Your nonprofit may prefer donations (or immediate support) to pledges, which are usually promises to donate in the future. But if you do receive pledges, make sure to account for them properly.

Fundamental Differences Between Nonprofit and For-Profit Accounting

For-profit companies pursue … profits. But how, besides the obvious, are nonprofits financially different from their business brethren? Your new staffers and board members may need a quick tutorial.

Is Co-Sourced Accounting the Solution Your Business Needs?

Struggling to keep up with today’s complex accounting demands? Discover how co-sourced accounting can provide your business with the expertise and flexibility to thrive. Learn more in our latest article.

From Flights To Meals: A Guide To Business Travel Tax Deductions

If you are a business owner, it is important to take full advantage of the tax deductions allowed for business travel, as they can help reduce your taxable income.

Maximize Your Year-End Giving With Gifts That Offer Tax Benefits

If you are feeling generous as the holidays approach, you may want to give cash gifts to your loved ones. You should also consider avoiding any gift tax implications.

Navigating Challenges in Affordable Housing Projects

Discover the common challenges facing affordable housing projects, from financing issues to community opposition, and gain insights on overcoming obstacles to support affordable housing development.

Second Quarter 2024 | Peer Data for New England Banks and Credit Unions

Whittlesey has released our financial data compilation for New England banks and credit unions for the second quarter of 2024.

Taxes Take Center Stage in the 2024 Presidential Campaign

Election day is only a month and a half away. Here’s a rundown of the two candidates' major tax proposals.

It’s Time for Your Business to Think About Year-End Tax Planning

We’ll be saying goodbye to 2024 in no time. Here are some year-end moves to consider that may help your small business save on taxes.

Working Remotely Is Convenient, But It May Have Tax Consequences

For some employees who work remotely, the financial reality can be taxing. Here’s what to expect if you have a job but you don’t go to a physical office.

Does Your Company Have An EAP? If So, Be Mindful Of Compliance

Business owners: If you’re thinking about adding an employee assistance program (EAP) to your benefits package, or you already have one, be sure you and your team are up to speed on compliance.

Massachusetts Introduces New Tax Credits to Boost Affordable Housing and Community Investment

Discover how the Massachusetts Affordable Homes Act introduces new tax credits to support affordable housing and community revitalization. Learn about the qualified conversion project credit, homeownership tax credit, and extended incentives for historic rehabilitation and community investment.

Outsourcing HR Tasks Can Help Understaffed, Overworked Nonprofits

What factors should your nonprofit consider when outsourcing HR work? We look at benefits and drawbacks of outsourcing, as well as what you need to do to make it successful.

Are Your Volunteers Risking Legal And Tax Liability?

Most charitable volunteers don’t think about potential legal and tax liabilities resulting from their volunteer activities. As a nonprofit leader, it’s your responsibility to ensure they never have to worry about such risks.

Nonprofits: Take Another Look At Inflation Reduction Act Tax Breaks

You’d be forgiven for ignoring tax breaks contained in the Inflation Reduction Act. After all, they won’t help tax-exempt organizations. Or will they? We suggest you look at two provisions benefitting nonprofits.

Plan Now To Reimburse Staffers, Board Members And Volunteers

Every organization needs a reimbursement policy, even if you infrequently reimburse stakeholders for travel, meals and other expenses incurred on your nonprofit’s behalf. We explain what a policy should include.

Arm Your Nonprofit Against Financial Threats

The U.S. economy is generally stable for now. Still, you may be anxious about how economic changes could affect your nonprofit in the near future. Take this period of relative calm to fortify your organization’s finances.

Maximize Your Investments: Harness the Power of the De Minimis Safe Harbor Tax Rule

Learn how the de minimis safe harbor rule can simplify tax management for real estate investments and enhance your portfolio's growth.

Important Update: New Federal Overtime Pay Rule Affects 4 Million U.S. Workers

On April 25, 2024, the Biden administration announced a new rule extending mandatory overtime pay to approximately 4 million salaried workers in the United States.

Important Update for Nonprofit Organizations: Federal Uniform Guidance Single Audit Threshold Increases to $1 Million, and More

The single audit threshold has been raised from $750,000 to $1,000,000, providing more flexibility in programmatic and budgetary decisions and potentially reducing the audit burden for entities with federal funding below the threshold.

IRS Issues Guidance On Tax Treatment Of Energy Efficiency Rebates

The IRS has offered guidance regarding the tax treatment of energy efficiency rebates introduced by the Inflation Reduction Act.

Update On Retirement Account Required Minimum Distributions

The SECURE 2.0 law includes good news about required minimum distributions from tax-favored retirement accounts. But an earlier law contained some bad news for certain beneficiaries of inherited retirement accounts. Here are the rules.

President Biden’s Proposed Budget Highlights His Tax Agenda

President Biden has laid out his proposals for tax law changes in the fiscal year 2025 budget.

Corporate Transparency Act (CTA) Declared Unconstitutional by Federal Judge

A federal judge in the Northern District of Alabama has declared the Corporate Transparency Act (CTA), aimed at combating money laundering by requiring businesses to report ownership information, unconstitutional, putting its mandates on hold.

Small Businesses Can Gain Big with Outsourced Accounting

Discover how small businesses can leverage outsourced accounting for strategic growth and operational efficiency, gaining access to expert advice, scalable solutions, and cloud-based technologies for enhanced financial oversight.

Better Tax Break When Applying The Research Credit Against Payroll Taxes

Even if your startup business has little or no income tax liability, you may be eligible for a payroll tax credit election for increasing research activities. This tax break got better under the Inflation Reduction Act.

New Option For Unused Funds In A 529 College Savings Plan

It’s not unusual for parents to end up with unused funds in their children’s 529 college savings plans. There’s a new option that allows them to transfer unused funds in a 529 plan to a Roth IRA. Here are the details.

Consider These Two Issues Before Searching for New Staffers

To hire or not to hire in 2024? For nonprofit employers, the decision generally comes down to two major considerations. Learn what they are.

Opportunity Zones 101: Understanding the Basics

Explore the basics of Opportunity Zones established by the 2017 Tax Cuts and Jobs Act, offering tax incentives for investments in economic development across Connecticut.

Developing an Effective Policy for Reimbursing Volunteer Travel and Other Expenses

Establishing a clear reimbursement policy helps maintain transparency and trust among staff, board members, and volunteers. It sets clear expectations, ensures timely reporting of expenses, and aids finance and accounting teams in managing and validating expenditures according to the organization’s policies and goals.

Independent Contractor Vs. Employee Status: The DOL Issues New Final Rule

The deadline to comply with a new U.S. Dept. of Labor rule regarding worker classification is fast approaching. Is your company ready?

6 Ways Nonprofit Retirement Plans Are Changing

The SECURE Act 2.0 made some important changes to 403(b) retirement plans, which typically are offered by nonprofits to their employees. Is your nonprofit caught up on the law’s provisions?

Enhancing Business Resilience: The Role of Managed Services in Safeguarding Digital Assets

Uncover how Managed Service Providers (MSPs) fortify business resilience through comprehensive data protection strategies. Learn about their essential services, including data backup, disaster recovery, and regulatory compliance, expertly written by Whittlesey's Director of Networking Services, Dave Modzelewski.

10 Ways Construction Companies Can Tighten Up Their Estimates

Estimating is among the most important areas of proficiency for any construction business. Here are 10 ways to potentially improve your company’s estimates.

Check Your Construction Company’s Vital Signs With KPIs

Construction business owners, don’t fear the data! Choose and use the right key performance indicators to monitor your company’s performance.

Is Your Construction Firm Eligible for an Energy-Efficient Tax Break?

Construction business owners: Does your company substantially contribute to the design of government-funded projects? If so, you may be able to claim a valuable tax deduction.

Businesses: Do You Have To Comply With The New Corporate Transparency Reporting Rules?

The new corporate transparency reporting rules are complex, but failing to comply with them can be costly to businesses.

Nonprofits: Ready, Set, Audit!

Don’t let your nonprofit’s audit preparation become a last-minute sprint. Plan early so you’ll have the right records ready for review. We offer suggestions.

Trust And Internal Controls Can Coexist In Your Nonprofit

Trust tends to be the biggest potential fraud weakness for nonprofits. But by beefing up certain internal controls, you can continue to operate like a happy family and still reduce employee-perpetrated fraud.

Private Foundations: “Disqualified Persons” Must Color Within the Lines

If you lead a private foundation, you must go out of your way to prevent anything that might be perceived as a conflict of interest or self-dealing. Here’s how to color within the lines and stay out of trouble.

New Per Diem Business Travel Rates Kicked In On October 1, 2023

Many businesses, including small ones, may be subject to new beneficial ownership information reporting rules under the Corporate Transparency Act. Here’s what you need to know.

Is Your Business Subject to the New BOI Reporting Rules?

Many businesses, including small ones, may be subject to new beneficial ownership information reporting rules under the Corporate Transparency Act. Here’s what you need to know.

Cybercriminals Love Your Business

In today's digital era, consumer data fuels businesses, making it an irresistible goldmine for cybercriminals. You don’t need to have the resources of a major corporation to implement a robust cybersecurity program that will help you avoid the fallout of a data breach.

What To Do If Your CFO Or Controller Leaves

The Great Resignation has caused significant turnover at many organizations and finding replacements can be challenging in today’s labor market. Here are four questions to ask if your accounting team leader unexpectedly leaves.

FAQs About QuickBooks

What software does your organization use for its accounting needs? Here are answers to frequently asked questions about one of the most popular options: QuickBooks.

Now Hiring: 10 Questions to Ask Bookkeeper Candidates

Hiring a bookkeeper for your small business can be a daunting task. Here are some helpful tips.

5 Steps to Track Vehicle Mileage in QuickBooks

Keeping tabs on business mileage can be time-consuming. Here’s how to use accounting software to simplify matters.

Every Nonprofit Needs a Disaster Plan

Recent natural disasters in Hawaii and California should remind all nonprofit organizations to establish a disaster plan. Here’s how to help protect your people, operations and technology.

Navigating Tax Strategy for Construction Firms: Essential Q&As

Tax planning is crucial for construction business owners to maximize potential tax benefits. An effective strategy involves more than knowing credits and deductions.

Nonprofits: Outsourcing HR Could Save Time and Money

Is your nonprofit’s HR staff stretched thin? It’s hard, especially for small teams, to do everything required. Outsourcing some HR functions to external professionals could help.

5 Tips for More Easily Obtaining Cyberinsurance

Business owners: You know how important cybersecurity is to your company. If you’re thinking about buying cyberinsurance, here are some suggestions for optimizing the application process.

4 Ways to Reduce Volunteer Risk

What would happen if one of your nonprofit’s volunteers harmed someone while volunteering for you? No matter how much you prize them, volunteers present litigation risks. We recommend four best practices.

IRS Provides Transitional Relief for RMDs and Inherited IRAs

Some taxpayers can look forward to receiving transitional relief from the IRS related to the required beginning dates for taking required minimum distributions from retirement plans.

Beefing Up Benefits May Save Tax Dollars For Construction Businesses

Construction business owners: Is your benefits package competitive in today’s tight job market? Here’s a review of some of the most valued options to consider.

Strategic Tax-Planning Q&As For Construction Businesses

Most people, including construction business owners, feel a sense of relief when their taxes are filed. But contractors need to make tax planning a year-round activity. Here are some Q&As to consider.

5 Tips For Avoiding Profit Fade

Experienced contractors know the pain of seeing a potentially lucrative job incur costly losses. Here’s how to fight back against profit fade.

Use Proactive Measures To Manage Materials And Labor Costs

Construction business owners: Are you doing everything you can to manage materials and labor costs in today’s inflationary environment? Here are some strategies to consider.

11 Ways Your Construction Company Can Avoid Accounting Mistakes

Construction companies can’t afford to make mistakes on job sites, and they shouldn’t make them in their books either. Here are 11 tips for avoiding accounting errors.

How Construction Companies Can Cope With The Skilled Labor Shortage

Construction company owners: Are you tired of the skilled labor shortage? Unfortunately, the struggle goes on, but there are ways to manage.

Are Your Nonprofit’s Interim And Year-End Financial Statements At Odds?

Whether your nonprofit uses cash basis or accrual basis accounting can affect the likelihood that your financial statements will need to be adjusted at year end.

New-And-Improved Accounting Rules For Common Control Leases

Coming soon! The FASB recently issued amendments to help organizations that rent property from related parties report those arrangements on their balance sheets.

Passing The Public Support Test

Is your nonprofit a publicly supported charity? Are you sure? Two IRS public support tests can help you determine, and prove, your status. Learn more about them:

Retirement Account Catch-up Contributions Can Add Up

If you’re eligible and not making catch-up contributions to your retirement plan, you’re missing out on building more tax-favored savings. Here are the rules of the road.

Make Your Nonprofit’s Auction A Success By Following IRS Rules

Auctions can be an effective way to raise funds. But they can also trip up nonprofits (and donors) that don’t follow tax rules. We summarize some of the most important issues.

Overcoming Benchmark Resistance In Your Nonprofit

Who needs benchmarking? You, your nonprofit’s employees and board of directors do! We explain how best to measure performance to reach mission-critical goals.

Why Nonprofits Need To Track Staffers’ Time

Nonprofits are obligated to track time worked by both hourly and salaried workers. So it’s critical to know what’s required and to implement best practices.

How To Train Your Nonprofit’s Employees To Combat Hackers

If you want to reduce the likelihood of a successful hacking attack on your nonprofit, focus on employee training.

Data Analytics Is More Accessible Than You Might Think

These days, data analytics is essential to for-profit business decision-making. What about nonprofits? Learn how these tools can help your organization reach goals more efficiently.

Commit to Continually Improve Your Nonprofit’s Accounting Processes

Accounting inefficiencies and errors can cost your nonprofit time and money. Here’s how to root out and repair less-than-perfect processes.

Should You Reassess Your Nonprofit’s Office Space?

Leased office space is likely one of the largest line items in your nonprofit’s budget. Now may be a good time to downsize or at least change how you use your space.

Understanding Connecticut’s Data Privacy Act

This guide will provide an overview of CTDPA’s applicability, requirements, enforcement, and how advisors can help your business achieve compliance.

Connecticut Overhauls Pass-Through Entity Tax (PTET), Making It Optional

Beginning in 2024, Connecticut will make PTET elective rather than mandatory.

Tax-Savvy Succession Planning: Minimizing Tax Liability for a Seamless Transition

For many business owners, succession planning is critical to their long-term strategy. Ensuring a seamless business transfer to the next generation or a new owner requires careful consideration of various factors, including tax implications.

Avoid Succession Drama with a Buy-Sell Agreement

Building a buy-sell agreement into your succession plan is strongly advised if your business has multiple owners. Here’s how these arrangements work.

Social Security’s Future: The Problem and the Proposals

The future of Social Security is in peril. Here’s a look at the current situation and potential solutions.

Unlocking Financial Opportunities: Navigating the New Markets Tax Credit Program

Explore the New Markets Tax Credit Program: a unique funding opportunity for businesses and nonprofits investing in distressed areas.

Keeping in Compliance with Uniform Guidance

Government grants usually come with certain obligations. Here’s what you need to know to help ensure your nonprofit complies with Uniform Guidance rules for recipients of federal funds.

The Tax Advantages of Hiring Your Child This Summer

Thinking about hiring your high-school or college-age child to work in your business? You could reap significant tax benefits.

Should Your Established Nonprofit Sponsor a Smaller Project?

It’s easy to see why small charitable projects seek fiscal sponsorships, but your established nonprofit may also benefit from sponsoring a group. Learn more about fiscal sponsorships.

SVB Collapse and Lessons Learned

On Friday, Silicon Valley Bank (SVB) became the first bank to fail in nearly three years and the largest to fail since the financial crisis of 2008-2009. Here are some lessons learned from the collapse.

U.S. Supreme Court Rules Against the IRS on Critical FBAR Issue

In Bittner v. U.S., the U.S. Supreme Court ruled that the penalty for non-willingly failing to file an FBAR applied on a lower per-report basis, not on a per-account basis.

Supreme Court: Overtime Rules Still Apply to Highly Compensated Employees

Many businesses today are short-staffed, making overtime a distinct possibility. A recent U.S. Supreme Court decision serves as a reminder that the overtime rules aren’t always easy to follow.

There Still May Be Time to Make an IRA Contribution for Last Year

If you want to help ensure your financial security in retirement, saving now is one of the best moves you can make. If you qualify, you still have time to contribute to an IRA or SEP and save on your 2022 tax return.

How Will the Infrastructure Investment and Jobs Act Affect the Real Estate Industry?

The Infrastructure Investment and Jobs Act (IIJA) is expected to increase funding for infrastructure projects across the US, benefiting the real estate industry. Businesses can take advantage of the IIJA by checking if they qualify for any benefits and applying for funds for various projects.

Third Quarter 2022 HUD Report: Nonfarm Payrolls and Housing Market Update

The Third Quarter 2022 HUD Report provides an update on nonfarm payrolls and housing market conditions in New England. While the economy saw job growth, the housing market remained tight with declining home sales due to rising mortgage rates, and the apartment market varied from balanced to tight.

Rising Demand for Multifamily Housing Creates An Opportunity for Developers to Invest

As multifamily housing remains the most sought-out property type, the incentives available may make it the ideal time for developers to invest.

Construction Businesses Must Step Carefully When Hiring On-Site Labor

Construction business owners: Are those with hiring power at your company up to speed on the FLSA and its rules regarding employees vs. independent contractors?

Prevent Fraud At Your Construction Company With A Holistic Approach

Fraud is an ever-present threat for construction businesses, both in the office and on jobsites. That’s why contractors must leave no stone unturned when trying to prevent it.

Manage Your Construction Business…And Your Wealth

Construction business owners: Are you paying as much attention to your personal wealth management as you are to your company’s financials? It’s important to balance the two.

Putting Accountability Into Practice

Nonprofits that embrace accountability can generally expect improved collaboration and better outcomes. How can your organization put this abstract concept into practice?

The FLSA Asks Your Nonprofit to Accurately Classify Staffers

Drawing a line between employees and contractors requires nonprofits to use their judgment. Getting it wrong can result in penalties and other costs, so take steps to get it right.

ASU 2016-13 Current Expected Credit Losses (CECL): Does it Affect Your Nonprofit?

Accounting standard ASU 2016-13 takes effect for fiscal years starting Dec. 15, 2022. Is your nonprofit ready? Find out whether the new standard might apply to your organization and how to prepare.

Year-End Spending Package Tackles Retirement Planning, Conservation Easements

Tucked into the Consolidated Appropriations Act of 2023 is a package of enhanced retirement benefits, otherwise known as the SECURE 2.0 Act. Here are some of the provisions.

Operating Reserves Can Help Cushion Financial Blows

Building or replenishing nonprofit operating reserves can take time. But you need a financial cushion, particularly when the economic future looks uncertain. Learn more about finding funds to grow reserves.

Accounting Policies and Procedures are Essential for Nonprofits, Too

Not-for-profit entities may not focus on earnings per share, but that doesn’t mean they can afford to neglect their accounting function. Here are some tips to help nonprofits run a well-oiled accounting department.

Protecting Your Nonprofit from Data Breaches

There are many low-cost (and even free) cybersecurity tools available to nonprofits, so don’t take the risk of going unprotected. Here are some easy ways to prevent data breaches.

9 Cash Flow Management Tips for Construction Companies

Construction businesses face great challenges when it comes to managing cash flow. Here are nine ways to help your cause.

Inflation Reduction Act Expands Deductions for Energy Efficient Construction

Can you benefit from the Inflation Reduction Act’s expansion of two tax incentives for energy-efficient construction of commercial and residential buildings? These are the Sec. 179D deduction and the Sec. 45L credit.

5 Year-End Tax Strategies for You to Consider

Here are a few effective tax techniques to help lower taxes for you or your business.

Is Your Income High Enough to Owe Two Extra Taxes?

There are two special taxes that may have a significant effect on the tax bills of high-income folks: the 3.8% net investment income tax and a 0.9% additional Medicare tax on wage and self-employment income. Here are the basic rules.

Year-End Tax Planning Ideas for Individuals

By planning ahead now, you may be able to save on your 2022 and 2023 tax bills. Here are some ideas to consider.

Don’t Forget Income Taxes When Planning Your Estate

With the current federal estate tax exemption at $12.06 million, you may not be worried about estate taxes. But you should still think about saving income taxes for your heirs.

10 Easy Tips for Lowering Your Cyber Insurance Premium

Are you paying too much for your cyber insurance? You don't have to overspend. Here are 10 ways to lower your cost and save more money.

5 Essential Cybersecurity Practices to Safeguard Your Business

Learn the 5 Essential Cybersecurity Practices every business needs. From compliance to risk assessments and employee training, these steps can save your business from costly breaches and reputational damage.

For a Stronger Nonprofit, Increase the Number of Income Streams

The pandemic tested the financial mettle of most nonprofits. If yours has only barely survived the trial, you may need to increase the number of revenue streams feeding into your budget. Here’s how.

A Financial Dashboard Can Take Your Nonprofit Where It Wants to Go

Similar to the dashboard in your car, a financial dashboard is an instant visualization tool that can tell you whether your nonprofit is running smoothly and efficiently. But it’s critical that you choose the right metrics.

How Your Nonprofit Can Break Bad Budget Habits

Your nonprofit may not have always approached its budget efficiently and productively or received the results it wanted. But it’s never too late to try some new budgeting ideas.

Clean Vehicle Credit Comes with Caveats

The Inflation Reduction Act’s Clean Vehicle Credit might alter the timing of purchasing a new or used qualifying electric vehicle. Learn why.

Year-End Tax Planning Ideas for Your Small Business

Before you know it, the end of 2022 will be near. Here are some year-end moves to consider that may help your small business save on taxes.

Are You Staying Ahead of Your Construction Company’s Backlog?

Generally, a construction business with a healthy backlog is working from a position of financial strength. That’s why contractors need to monitor backlog carefully.

Tighten Up Billing and Collections to Mitigate Economic Uncertainties

Business owners, are you worried about the U.S. economy? Tightening up billing and collections processes could help ease your mind.

The Kiddie Tax: Does It Affect Your Family?

Do your children have investment income? They may owe “kiddie tax.” Here are the basic rules.

Classify Your Nonprofit’s Workers Correctly — or Risk Repercussions

Does your nonprofit rely on contractors to get the work done? Make sure these workers are classified accurately or you may face federal scrutiny and financial penalties.

Conflict-of-Interest Policies: It’s About Trust

Your nonprofit needs a conflict-of-interest policy. Good governance demands it, your stakeholders expect it and even the IRS wants to know how you prevent conflicts.

Nonprofits: Seize the Day with Real-Time Strategic Planning

Is your nonprofit’s current strategic plan uninspiring? Does it prevent you from leveraging current opportunities? Real-time strategic planning enables organizations to capitalize on their competitive advantages.

For Nonprofits, Quid Pro Quo Isn’t a Simple Exchange

Donors may automatically assume they can deduct the full amount of any charitable contribution. But what if your nonprofit provides goods or services in exchange for donations?

Do You Know the Signs of Financial Distress in a Business?

Financial distress rarely happens overnight. There are usually red flags indicating that trouble in your business is brewing, but it might take some effort to spot them.

What Charitable Givers Need to Know About Taxes

Due to pandemic relief legislation, the tax treatment of charitable donations has changed (and changed back) in the past couple of years. Do your donors know the current rules? You can help inform them.

Now That You've Filed Your Tax Return, Consider These 3 Issues

Once your 2021 tax return has been filed, there still may be some issues to consider. Many people have questions about how to find their refund status, which records can be thrown out and when to file amended tax returns.

Tax Issues to Assess When Converting from a C Corporation to an S Corporation

With real estate prices up in some markets, the “like-kind” exchange strategy may be attractive if you want to sell commercial or investment real estate.

Defer Tax With a Like-Kind Exchange

With real estate prices up in some markets, the “like-kind” exchange strategy may be attractive if you want to sell commercial or investment real estate.

The Tax Rules of Renting Out a Vacation Property

A vacation home is more than just a place to relax. It also may provide tax breaks. Here are the rules if you rent it out for part of the year.

Take Your Financial Statements to the Next Level

Financial statements should be more than an exercise in compliance. Fit companies put their financials to work for them.

Should Your Business Address Retirement Plan Leakage?

Business owners who offer employees a qualified retirement plan should familiarize themselves with the term “leakage” and how to help prevent it.

Approach Turnaround Acquisitions with Due Care

Could your business acquire a struggling competitor this year? Be sure to fully explore the benefits and risks of any prospective deal before getting too far down the road.

A Credit Card Use Policy Can Help Prevent Abuse

Manager involvement is essential to helping prevent credit card abuse. If you allow staffers to use your nonprofit’s card, make sure they understand how they’re authorized to use it. To craft a card use policy, read on.

How to Assess Your Organization's Fraud Risks

In today’s uncertain marketplace, it’s important to look at fraud risks from a fresh perspective. Here’s how auditors are doubling down in their efforts to accurately assess emerging and increased fraud risks during the pandemic.

Handle Your Nonprofit’s Restricted Gifts With Care

Most nonprofits prefer unrestricted gifts, but you probably don’t want to say “no” to donations that come with a few strings. Just make sure you handle restricted gifts with care. Here’s how.

Keeping Meticulous Records is the Key to Tax Deductions and Painless IRS Audits

A careful approach to keeping business records can protect your tax deductions and help make an IRS audit much less difficult. Here are two cases to illustrate some of the issues involved.

3 Steps to a More Financially Resilient Future for Your Nonprofit

Charitable giving is picking up and there are other signs that suggest 2022 will be less challenging for nonprofits. But to help ensure your nonprofit can overcome obstacles, consider taking these three financial steps.

Use Change Management to Brighten Your Company’s Future

In the year ahead, businesses will need to continue transforming in response to public health and economic developments. Change management can help your company handle the challenge.

With Year-End Approaching, 3 Ideas That May Help Cut Your Tax Bill

Before you know it, we’ll be ringing in 2022. You may still have time to reduce your 2021 federal tax liability by taking these steps.

Factor In Taxes If You’re Relocating to Another State in Retirement

Moving closer to family members and taking advantage of warmer weather are just two reasons why many people retire to another state. Don’t forget to consider state and local tax implications before you make a move.

When Nonprofits Should Return Donations

Instead of waiting to see if donors will ask for their money back, take steps to prevent such requests. Learn when your nonprofit should return a donation and what your refund policy should say.

Would You Like to Establish a Health Savings Account for Your Small Business?

Looking for a flexible, tax-advantaged option for providing health care coverage at your business? Consider a Health Savings Account. Employers and employees can benefit.

4 Ways to Refine Your Cash Flow Forecasting

Business owners, you may not have a crystal ball, but you can forecast cash flow. Here are four tips to consider.

Webinar: Choosing a Syndicator for a Low-Income Housing Tax Credit Project

Join our Whittlesey Real Estate Team and guest panelists in a discussion about choosing a syndicator for a Low-Income Housing Tax Credit Project.

Your Complete Guide to Building a Cybersecurity Program

If you're looking for your complete guide to building a cybersecurity program, we can help you out. Learn more about what you should know today.

Contractor Financial Statements: Where Sureties and Bonding Agents Focus

Here are some of the areas that sureties and bonding agents are focusing on for your financial statements and how Whittlesey can help.

Nonprofits: Limit Disaster Damage with A Plan

To help ensure the safety of their people and limit property damage, all organizations need to prepare for possible disasters. But some organizations need to plan more extensively. Is yours one of them?

Tackling Volunteer Liability Issues

Allegations of volunteer negligence and intentional misconduct often motivate lawsuits against nonprofits. Here’s how to manage risk and reduce potential losses associated with volunteers.

Is Your Nonprofit Complying with Federal Procurement Requirements?

If your nonprofit doesn’t comply with recently updated federal procurement guidelines, it could risk its funding. Here’s how to ensure your policies and purchases adhere to the rules.

Expanding Succession Planning Beyond Ownership

Business owners, have you considered creating a succession plan that also accounts for the possible departure of key employees?

HR Outsourcing: Considerations for Nonprofits

Which HR functions could your nonprofit potentially outsource? Here’s how to identify them and determine the benefits and drawbacks of engaging an outside service provider.

Financial Statements: Take the Time to Read the Entire Story

Financial statements tell a story about financial performance. Managers and other stakeholders who read them from cover to cover have a clear, holistic understanding of the details.

Tax-Favored Ways to Build Up a College Fund

Your college savings can go farther with tax-favored vehicles. Here are some options.

Does Your Nonprofit Owe Tax on Its Sponsorships and Advertising?

Distinctions between taxable advertising and nontaxable sponsorships can be nuanced. Before seeking new income sources, figure out if they’re potentially subject to unrelated business income tax.

Getting A New Business Off the Ground: How Start-Up Expenses Are Handled on Your Tax Return

Business applications have increased over the past year, according to the U.S. Census Bureau. If you’re launching a business, here’s how start-up expenses are treated on a federal tax return.

The Long and Short of Succession Planning

Have you created a viable succession plan for your business? This daunting task can be made easier by choosing the right perspective.

Still Have Questions After You File your Tax Return?

Congratulations if you filed your 2020 tax return by the May 17 deadline. But you may still have questions. We’re often asked about refund status, record retention and amended tax returns. Here are some answers.

It May Be Time To Tune Up Your Nonprofit’s Accounting Function

Nonprofit accounting systems can become inefficient and less effective over time if they aren’t monitored. You should regularly review your accounting function for these potential upgrades.

Rebuilding your Nonprofit’s Operating Reserves

Three months, six months, 12 months? When rebuilding your nonprofit’s operating reserves, how much in expenses should you try to put aside? It may determine how well you survive the next crisis.

Don’t Make Decisions Without Data Analytics

Data analytics can help your nonprofit validate trends, uncover root causes and improve transparency. But before you select a data analytics package, read this.

Tax Credits and Deductions for Businesses Going "Green"

Did you know there are several ways to save your business money while being environmentally savvy? Whether your business is considering an electric vehicle or maybe a solar energy-powered building, there are tax credits and deductions for that!

Providing Optimal IT Support for Remote Employees

The COVID-19 pandemic has accelerated the trend toward allowing employees to telecommute. In turn, effective IT support has become an important contributor to profitability.

What Are In-Kind Contributions? The latest on guidance, qualifications, and how to record

Many nonprofit organizations rely on non-financial gifts of goods and services as vehicles to achieve the organization’s mission or goals. These goods and services are considered in-kind contributions.

Launching a Small Business? Here Are Some Tax Considerations

For tax purposes, there are many ways to conduct a business. For example, you may operate as an S corporation or a partnership. But many new ventures start out as sole proprietorships. Here are some tax considerations involved in operating with that entity.

What are the Tax Implications of Buying or Selling a Business?

Buying or selling a business may be the largest transaction you’ll ever make. Pay attention to taxes. After a deal is done, it may be too late to get the best tax results.

Should Your Nonprofit Accept that New Grant?

Government or foundation grants can help your nonprofit expand its reach and improve its effectiveness. But they also may hamstring your organization in several unexpected ways.

Private Foundations Need Strong Conflict-of-Interest Policies

Even if your private foundation has good intentions, it may not be enough. You need a conflict-of-interest policy and a comprehensive understanding of what constitutes self-dealing to avoid IRS scrutiny.

How Nonprofits Should Classify Their Workers for Tax Purposes

How do you pay your nonprofit’s workers? This is just one question you must ask to properly classify staffers as employees or independent contractors. We look at several factors the IRS considers.

When Nonprofits Need to Register in Multiple States

The Treasury has issued a final interim rule regarding the Paycheck Protection Program.

Outsourcing Your Nonprofit's Accounting Functions

Nonprofits might choose to outsource their accounting functions for a variety of reasons. Whatever the reason, there are always pros and cons to this important decision.

Is It Time to Team Up? The Benefits of Nonprofit Collaboration

Partnering with a like-minded organization potentially enables you to pool funds, staff and supporters — temporarily or permanently. Learn more.

Hiring Independent Contractors? Make Sure They’re Properly Classified

During these tough times, your business may be saving money by using independent contractors, rather than hiring employees. Make sure to follow all the rules or you could hear from the IRS.

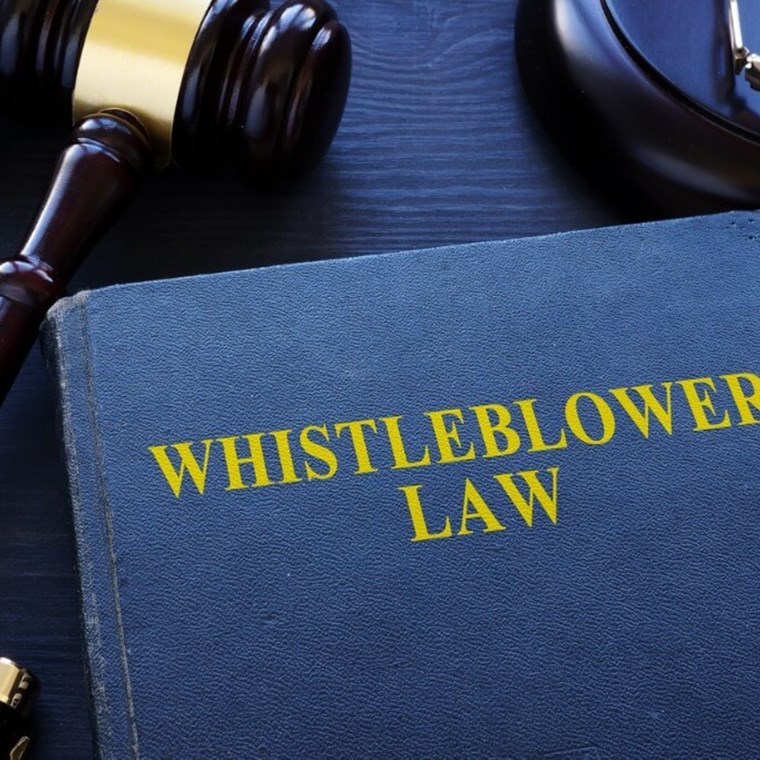

Ensuring Your Nonprofit Protects Whistleblowers

Does your organization properly protect whistleblowers? If not, it should.

An Operating Reserve is Your Nonprofit’s Financial Safety Net

If nonprofit hits a budget shortfall or other financial emergency, you’ll be glad you have the safety net of your operating reserve.

Nonprofit Employers Can Save On Taxes with Accountable Plans for Staff

Nobody likes to be taxed after shelling out money for a job-related expense. But that’s what happens when employees receive reimbursements from an organization without an accountable plan. Learn more.

Your Succession Plan May Benefit From A Separation Of Business And Real Estate

Separating business and real estate may benefit your succession plan? Find out if this may benefit you.

Deciding Whether A Merger Or Acquisition Is The Right Move

Is a merger or acquisition the right move for your company? Find out.

Tax Guide for Valuing Donated Property

Nonprofits often struggle with valuing noncash and in-kind donations. Whittlesey's tax guide can help.

Is There Substantial Doubt About Your Nonprofit's Future?

GAAP requires nonprofits to regularly evaluate whether there’s “substantial doubt” about their ability to continue as a going concern.

What Key Performance Indicators Matter For Your Nonprofit?

Four key ratios are critical to ensuring your nonprofit is achieving its mission as cost-effectively as possible. Learn more.

What To Do If My Nonprofit Receives an IRS Audit Letter?

Is your nonprofit prepared to handle an IRS audit letter? For example, do you know the difference between a field and a correspondence audit? Get the facts.

Should You Say “Good-Bye” To Your Nonprofit’s Old Bylaws?

Are your nonprofit's bylaws outdated? If so, you can’t just start revising them. There are other considerations you must tackle first. Read more about them.

When Holiday Gifts and Parties are Tax Deductible

Find out if your holiday gifts or parties are tax deductible or whether it's taxable for the recipient.

How to Control Unemployment Tax Costs for Your Business

Unemployment taxes can be costly for your business. Fortunately, you may be able to reduce your unemployment tax bill.

Tax Smart Ways to Withdraw Cash from Your Corporation

Are you looking to withdraw cash from your corporation while avoiding a hefty tax cost? Here are 5 ways to avoid dividend treatment.

Classifying Workers as Employees or Independent Contractors

Making employees independent contracts can yield savings but don't do it just to lower your tax burden.

Preserving Your Association’s Tax-Exempt Status

If your nonprofit engages in certain activities, it will lose its tax-exempt status with the IRS. Do you know what those activities are?

Encouraging Donors to Switch Donations to Unrestricted

A gift with strings attached is nice but not as nice as a gift you can use however you like.

How to Make Your Nonprofit's Events More Profitable

Make sure you get the most out of your nonprofit's special events while still keeping them fun.

Importance of Board Review of Form 990

Whittlesey nonprofit expert, Katrina Olson highlights the importance of Form 990 and offers helpful tips on filling it out.

What to Do in the Event of a Cybersecurity Attack: A Step-by-Step Guide

What to do after a cybersecurity attack: Learn the critical steps to minimize damage and protect your business with Whittlesey Technology's expert guidance.

An Incident Response Plan Can Reduce the Cost of a Cyber Attack

Plan now how you'll react to a cyber attack instead of having to make choices in the moment.